The

Who we are →

What We Do

Professional advice, personal touch

Welcome to Castletons – your friendly and approachable accountants based in Wilmslow, working across Cheshire, Manchester and beyond.

WHO WE ARE

Meet our bright sparks

Jackie Ford

FCCA

Director

Jacqueline qualified in 1993 as a Chartered Certified Accountant and then set up her accountancy practice in Wilmslow. She specialises in providing business advice, tax advice and accountancy services to owner-managed businesses. She has vast experience in accounts and works closely with clients to ensure their business objectives are achieved. She also has a wide knowledge of taxation, VAT and PAYE issues and is therefore able to solve most clients’ issues quickly.

As a business owner herself she faces the same challenges as her clients and works with them to find solutions to problems. Jackie’s specialisms include: Cloud accounting, in particular Quickbooks; Audit & Accounts Preparation; Management Accounts; and providing business advice to her clients.

Jackie enjoys travelling, in particular around Spain, where she practises her Spanish. She also enjoys cooking, shopping and walking her dogs.

Contact Us →

Andrew Ford

FCCA

Director

Take That were number one in the charts (on their first time around!) and Frank Bruno was about to become Heavyweight Champion of the World when Andrew qualified as a Chartered Certified Accountant!

After spending his formative years at one of the UK’s leading Firms and becoming a senior manager at a firm renowned nationally as being at the forefront of business advisory services, Andrew joined Jackie in their own accountancy practice in Wilmslow, South Manchester, in 2000.

With a broad background in “non-Compliance” he spends a lot of his time helping clients with ad-hoc advice and assistance using experience gained in almost 30 years working with owner-managed businesses.

In his spare time Andrew enjoys all things Spanish and is a keen cyclist and motorcyclist.

Contact Us →

Siobhan Ford

BA(Hons) FCCA

Director

For as long as she can remember, Siobhan has been in and out of her parents’ business, being exposed to accountancy and what’s different about Castletons. Having achieved her degree in International Business, Finance and Economics at the University of Manchester, Siobhan joined the Practice in earnest and began studying to be an accountant. Siobhan became a qualified accountant with the ACCA in 2020 and a Director of Castletons in 2023. Siobhan specialises in accounts preparation, management accounts, as well as cloud accounting, particularly QuickBooks.

Contact Us →

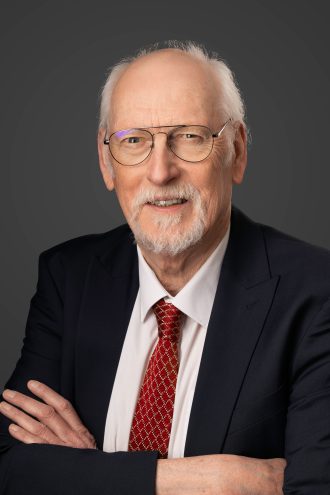

Dermot Murphy

FTCA, FIAP, MCIPP

Tax Consultant

Dermot started his career in 1971 working as a tax investigator for HMRC. In 1977 he went into private practice and in 1979 he joined forces with Roy Loughran to start Loughran & Murphy. In 2023 Loughran & Murphy joined Castletons Accountants, with Dermot providing tax consultancy advice to our clients.

When he’s not on the golf course, Dermot spends his spare time enjoying fine wines and walking the family’s multitude of rescue Yorkshire Terriers.

Contact Us →

Janet Tatler

Accountant

Janet joined Castletons in 1998. She has worked in accountancy since 1973 and has gained a wealth of experience in preparing sole trader and limited company accounts, and tax returns.

Janet enjoys running and has been a member of Macclesfield Harriers for a number of years. She also plays badminton a couple of times a week.

Contact Us →

Sue Barnes

Payroll Manager

Sue joined Castletons in 2002 and has over 25 years’ experience working in the accountancy sector. She specialises in payroll and manages our weekly and monthly payrolls for a wide variety of businesses ensuring that all their obligations are met accurately and in a timely manner.

When not at work, Sue enjoys walking in the countryside and socialising with friends and family.

Contact Us →

Laura Van Wyk

Accounts & Bookkeeping

Laura joined our team in January 2023 with 12 years’ bookkeeping and accountancy experience.

In her spare time, Laura enjoys going for rides out with her husband on his motorcycle (when the weather allows). She also enjoys adult colouring which she finds therapeutic and a fun way to relax.

Contact Us →

Matthew Duxbury

BA(Hons) ACCA

Accountant

After achieving a BA (Hons) in Accounting and Finance at Manchester Metropolitan University, Matthew joined Castletons in 2021 and we supported Matthew in becoming a qualified accountant in 2024. Matthew Matthew helps our clients with their payroll, bookkeeping and accounting needs.

Contact Us →

Jordan Kelly

BSc

Accountant

After achieving a BSc in Accounting and Finance at Liverpool John Moores University, Jordan joined Castletons in 2022. Jordan currently helps clients with their payroll, bookkeeping and accounting needs. Jordan is a lifelong fan of Bolton Wanderers Football Club.

Contact Us →

Helen Newbould

Personal Tax Manager

Helen has over 35 years’ experience working in the accounting sector, having started in the accounts department preparing limited company accounts before moving into personal tax in 2010 providing tax compliance for a range of clients from individuals to estates and trusts. Helen joined Castletons in 2025.

Outside of work Helen likes to spend time with her family in their touring caravan, horse riding with her daughter and socialising with family and friends.

Contact Us →

Rob Robinson-Lee

Bookkeeping & Cloud Accounting Manager

Rob joined Castletons in 2025 as our Bookkeeping & Cloud Accounting Manager, after working in practice for over 15 years. He helps clients with all their VAT and Bookkeeping needs and also specialises in Accounting Software. In his spare time he loves nothing more than watching the F1 and a tumbler or two of a nice scotch at the weekend!

Contact Us →

Sarah Holme

Practice Manager

Sarah joined our team as Practice Manager at the beginning of 2020. Sarah brings a wealth of administrative experience having previously worked in the Legal and Private Healthcare sectors managing large teams of administration staff.

In her spare time Sarah enjoys socialising with friends and spending time with her family. Sarah also enjoys walking and has completed a couple of challenges, including the Yorkshire Three Peaks and Ben Nevis – and she enjoys a glass of Bombay Sapphire at the end of her challenges!

Contact Us →WHAT YOU SAY

Hear from our clients